Nov 12 ,2020 | Categories: 1

Put simply, an interest rate is how much it costs to borrow the cash. Most loan interest rates are annual rates.

However, interest is calculated monthly, but it’s quite simple to work out how much you’ll pay in interest:

Let’s look at a 3% rate on a 150.000 € loan:

And that’s what you’ll pay in interest each month. Sort of...

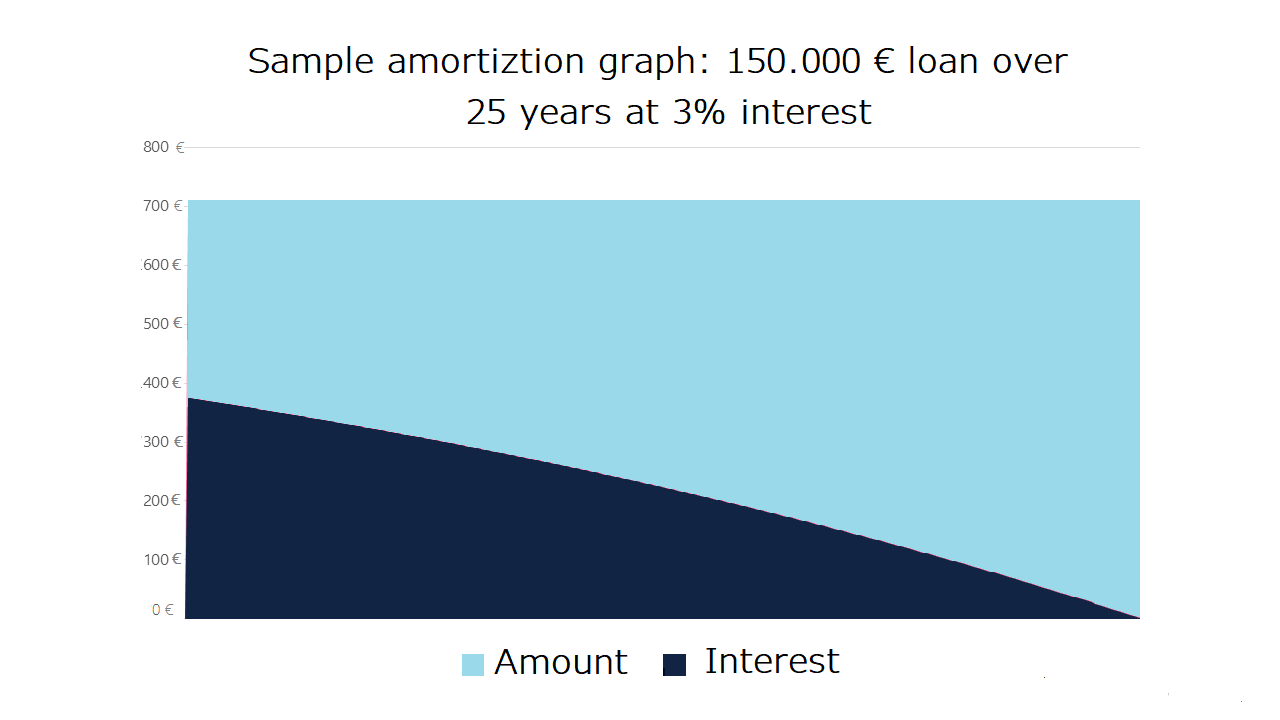

Of course, your actual loan amount will decrease as you pay it off every month, which you’d think would mean that the repayments should go down as total interest prices drop. But it doesn’t. And that’s because of lovely amortization.

Basically, your bank will work it so that you have the same monthly payments throughout the term, but a higher percentage of that will be interest at the start of the term, while at the end of the term, the interest proportion will be lower and the amount you repay of the loan higher.

Here's roughly what you can expect to happen with your monthly repayments:

The annual percentage rate (APR) is the loan interest rate plus other charges, which could include fees, charges and discounts. By the way, a representative APR is the APR at least 51% of successful applicants get.

As mentioned, most lenders work out your interest on a monthly basis and advertise the rate on an annual calculation.

With a daily interest or simple interest loan, interest will be added to your balance each month based on the number of days in the coming month.

You’ll see a decreasing monthly balance which will take into account the amount you paid last month and the amount of interested added for the coming month. There’s not a huge amount in it between daily and monthly interest, with the difference between the longest and shortest month being just 3 days.

On an annual interest loan, your lender will take your balance on 31st December of the previous year, calculate the amount of interest they expect you to pay in the coming year, and divide that amount by 12.

In the first year of your loan, they’ll take the balance from the date they lend it to you and calculate what they expect you to have to pay until 31st December.